Create your Offers

Manual offer management

In this tutorial you will learn how to...

- manually manage your offer data

- manually maintain and edit your offers

Offer management via file

In this tutorial you will learn how to...

- list your offers

- set up the Automatic data adjustment

- activate the automatic file upload

- configure your offer file

What does a suitable CSV file look like?

What does a suitable XML file look like?

XML example files:

Transfer of tax rates per offer

In view of the impending tightening of regulations for the platform/marketplace economy due to the EU Directive ViDA (VAT in the Digital Age), Kaufland Global Marketplace has adapted the requirements for indicating VAT rates on Kaufland marketplaces. Sellers now have the option of directly entering their VAT rates when they create an offer.

Who is affected by the new regulation?

1. Sellers who fall under the “deemed supplier” model.

You are subject to the “deemed supplier” model if

- shipments of goods are sent from an EU location to EU customers and the seller is not based in the EU;

and

- shipments of goods are sent from a non-EU location directly to EU customers (regardless of your tax residency) and the value of the shipment does not exceed €150.

The VAT rates you provide will be binding for your offers from mid-August.

What happens if VAT rates are accidentally entered incorrectly or not at all?

If you do not enter a VAT rate for your offers, the system automatically applies the standard maximum VAT rate for the respective sales channel (Kaufland.de, Kaufland.cz, Kaufland.sk and, once launched, Kaufland.pl as well as Kaufland.at).

Example: If you do not enter a tax rate for an offer on Kaufland.de, despite there being a reduced tax rate of 7 percent, (such as for books), then the system automatically uses the standard German VAT rate of 19 percent for the VAT to be paid.

If you enter a reduced VAT rate and a future review reveals that this is incorrect, the system will automatically adjust the tax rate you entered to the maximum applicable tax rate.

2. All other sellers:

Sellers who do not fall under the “deemed supplier” model can already prepare themselves for the upcoming tax regulations by entering the VAT rates for their offers now.

How to enter your VAT rates

You can enter and manage your VAT rates directly when creating an offer.

Manual management in the Seller Portal:

Go to the detail view of your offer and enter the appropriate VAT rate in the VAT field.

View in the Seller Portal:

Via inventory feed file:

Procedures other than manual offer creation

Should you create your offers using the Inventory Feed file in the Seller Portal, you can save the VAT rates directly in the offer file using VAT indicators. Enter the appropriate “vat_indicator” for each VAT rate.

Table with valid VAT indicators

|

vat_indicator |

standard_rate |

reduced_rate_1 |

reduced_rate_2 |

super_reduced_rate |

zero_rate |

|

Country |

Country Code |

Standard VAT rate |

Reduced rate 1 |

Reduced Rate 2 |

Super reduced rate |

Zero rate |

| Kaufland marketplace countries |

Austria |

AT |

20.00% |

13.00% |

10.00% |

|

0.00% |

| Czech Republic |

CZ |

21.00% |

12.00% |

|

|

0.00% |

| Germany |

DE |

19.00% |

7.00% |

|

|

0.00% |

| Poland |

PL |

23.00% |

8.00% |

5.00% |

|

0.00% |

| Slovakia |

SK |

20.00% |

10.00% |

|

|

0.00% |

In countries where there is no Kaufland marketplace, the system automatically applies the standard maximum VAT rate of the corresponding country if no other tax rate is specified.

Via Marketplace Seller API V2:

Are you transferring your offer data to Kaufland Global Marketplace using an interface from a software partner? No worries, your software partner has already been informed. Please ask your software partner when the adjustments will be available.

If you use an in-house development interface (“Inhouse_development”) to access our Marketplace Seller API V2, you will find all the information you need concerning the transfer of the new “vat_indicator” optional parameter in our detailed API documentation.

-

What is the difference between product and offer data?

Product data refer to product attributes (size, material, etc.). Offer data contain information such as prices, shipping costs and delivery times.

In order to successfully list your articles on our platform, our system requires product data in the first step: Those contain mandatory attributes, as well as special attributes. Products that have not been created on Kaufland.de before, have to be created or uploaded first in the product data section.

So-called mandatory attributes have to be provided to ensure that the product is valid and can be offered in the second step. Special attributes can be added on a voluntary basis. Additional information about your product data can be found under https://www.kaufland.de/seller/product-data-overview/

After submitting your product data, you can create your offers. Additional information can be found under https://sellerportal.kaufland.de/offers/

-

What is the low price automatic and how can I use it?

The low price automatic ensures an automated price adjustment, based on the minimum price provided by you. It is thereby ensured that your offer is always one cent lower than your competitors’ prices – providing that other sellers offer the same product. Thereby, sales price including shipping costs is considered. To use the low price automatic you simply need to submit your minimum price with your offer data.

-

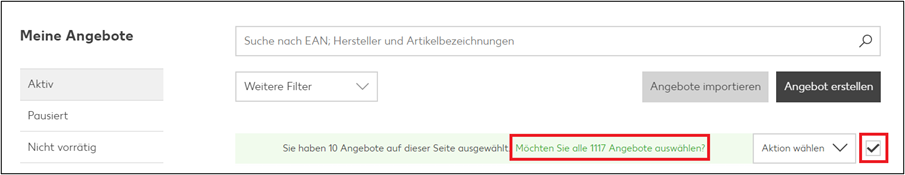

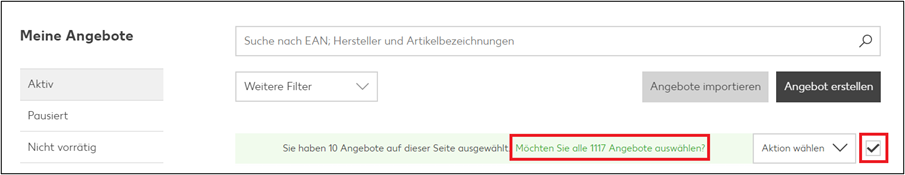

How can I manually adjust multiple offers at a time, e.g. delivery times or prices?

Go to https://sellerportal.kaufland.de/offers and tick the box in the upper right hand corner below the search bar to select multiple or all offers. Next, select the desired action from the drop down menu left to it. You have the following options:

- pause

- assign warehouse

- adjust prices

- adjust minimum price

- adjust delivery time

- change shipping group

- delete

-

Inventory feed file: How is the delivery time shown in the offer calculated?

- The delivery time displayed is made up of the handling time and the transport time.

- The handling time remains part of the offer data. You can edit the transport time in the shipping settings.

- The transport time is defined by each shipping group created. The transport time is the time it takes your shipping service provider to deliver the goods to an end customer in the respective region.

- The handling time for each offer is indicated in the new “inventory feed file” offer file type. The handling time is the time you need for the pick-and-pack process within your warehouse.

- The delivery time only comprises working days. Saturday is not considered a working day. Only the public holidays of the respective country to which you distribute your products are taken into account (e.g.: on Kaufland.de, German, nationwide public holidays are taken into account in the delivery time. On Kaufland.sk, Slovak holidays are taken into account in the delivery time and on Kaufland.cz, Czech holidays are taken into account). For example:

• on Kaufland.de, German nationwide public holidays are taken into account in the delivery time;

• on Kaufland.sk, Slovak public holidays are taken into account in the delivery time;

• Kaufland.cz, Czech public holidays are taken into account in the delivery time.

-

How do I set the delivery time for my offers?

You set your delivery time via the handling and transport time. Both values combined result in the delivery time displayed on the online marketplace.

Handling time: The handling time is the time it takes for the ordered item to be delivered to the shipping service provider. The handling time is set and submitted with your offer (i.e. via API V2, inventory feed file or when listing manually).

Transport time: The transport time refers to the average time required for the ordered item to be delivered to the customer by the shipping service provider: You specify the transport time in your shipping groups. This makes it possible to save different transport times for different target regions.

Example:

- you need one day for the item to be handed over to the shipping partner. The shipping service provider needs an average of 1 – 2 days until delivery to the customer for the shipping region concerned, e.g. Germany. Your settings will then be as follows:

• Handling time: 1

• Transport time: 1 - 2

- The delivery time displayed on the online marketplace is now made up of the handling time and the transport time. For the example above, the customer is shown a delivery time of 2 – 3 days.

- Please note: If you have already set a transport time in your shipping groups, but only submit the minimum and maximum delivery times with your quotes, the transport time will not be included. This only happens if you also specify the handling time.

Consideration of country-specific public holidays:

Only the public holidays of the respective country to which you distribute your products are taken into account, e.g.:

- on Kaufland.de, German, nationwide public holidays are taken into account in the delivery time;

- on Kaufland.sk, Slovak public holidays are taken into account in the delivery time;

- on Kaufland.cz, Czech public holidays are taken into account in the delivery time.

-

How can I change the handling and transport time for all items at once (mass editing)?

Transport time

You can already set the transport time centrally using your shipping groups. The transport time must therefore be changed for each individual shipping group.

Handling time

Changes to the handling time depend on the type of offer listing. You have the following options to adjust it:

- Listing via API interface: If you list your offers via API interface, you must set and define the handling time in your software. There are no other options to control this centrally via the Seller Portal.

- Listing via inventory feed file: If you upload your offers to us via file, you can set a central value for your handling time by using Offer Management > Manage imports > Configure offer file. To do this, tick the box on the right under “Handling time” (see screenshot) and enter a default value (e.g. 1). After saving and re-uploading your offer file, this value will be taken into account. This procedure is only possible if you have not entered a value for the handling time in your offer file.

- Listing manually: If you list your offers manually, you can adjust the handling time for all offers at once using mass editing by navigating to Offers. To do this, tick the Status box on the first page above the first offer in your offer view and all offers will be automatically selected. You can then make the desired mass change via Select action > Adjust handling time.

Please note: If you choose the manual method and then submit other values for your handling time via your interface or file, the manually set value will be overwritten.

-

Where can I see which delivery time I have set?

You can always check which delivery times you have set for your offers under Offers in your seller account. Alternatively, you can download a report of your Offered items under Reports and use it to check how your delivery times are currently set.