1. What will you learn in this tutorial?

Video in progress

Do you want to sell on Kaufland.de, Kaufland.cz or Kaufland.sk? It's easy with Kaufland Global Marketplace and just one registration!

Table of contents:

1. What will you learn in this tutorial?

Video in progress

Content

Sellers who want to sell with Kaufland Global Marketplace have two options to register for taxes.

For EU Sellers:

1. One-Stop-Shop (OSS) registration:

OSS is both an electronic portal and an electronic interface for online sellers to simplify VAT obligations for e-commerce sales to consumers within the EU. Each EU member state has an online OSS portal where businesses can register.

VAT returns for tax liability abroad can be made via the OSS procedure where the relevant company's registered office is located.

Further information on the OSS procedure can be found here.

You can already provide your OSS number during the registration process. Alternatively, you can add your OSS number in the onboarding settings under "Tax information" if you have not yet entered during registration.

2. Registration without OSS procedure:

If you do not use the One-Stop-Shop, you will need a country-specific VAT ID for each Kaufland sales channel. This ID is used to pay the tax directly in the respective countries.

For Non-EU Sellers:

1. Local taxes registration in the respective country:

As a non-EU seller, you must always carry out a country-specific tax registration and save the corresponding VAT ID for each sales channel as part of the onboarding process in the Seller Portal.

Our partner Hellotax offers support for all questions regarding taxes. Hellotax helps you to automate your tax processes professionally and efficiently.

You can find more information about our partner here.

We have listed important information on VAT registration in Slovakia for you here.

Important information about VAT registration in the Czech Republic is listed here. [Link will be included soon]

For each Kaufland sales channel, separate legal texts (general terms and conditions, cancellation policy, privacy policy, legal notice) must be saved according to the country of sale and country-specific law in the respective national language.

Our partner IT-Recht Kanzlei will support you in creating your legal texts for Kaufland.de, Kaufland.sk and Kaufland.cz. You can find more information about IT-Recht Kanzlei here.

EPR stands for "Extended Producer Responsibility".

You qualify as a seller/manufacturer subject to EPR registration if you

The specific EPR requirements differ from country to country. Because an EU directive is involved, they also exist in Austria and Poland in addition to Germany, Slovakia and the Czech Republic.

Frequently asked questions and answers regarding the procedure in the respective countries of sale are provided below.

On 1st July 2022, a new regulation came into force for distributors of packaging in Germany. Sellers now have to register via LUCID.

The LUCID registration is done personally by the seller, regardless of their company location. The commissioning of a LUCID registration by fulfillment service providers is not allowed.

You can register with the “Zentrale Stelle Verpackungsregister (ZSVR)” in the LUCID register.

After completing the registration, each seller will receive an individual LUCID registration number, which must be saved on Kaufland.de. A valid LUCID registration number is a prerequisite for registration and to sell on Kaufland.de and can be saved during the registration process.

In addition to the LUCID registration, sellers are also required to join a dual system in Germany. The dual system supports sellers in Germany in gradually making their packaging more recyclable and licensing it. You proceed as follows:

a. Licensing: You sign a license agreement with a German dual system (such as Interseroh+ via Lizenzero)

b. Data reporting: You report the packaging quantities you put into circulation to your dual system and enter the name of your dual system and the reported packaging quantities in your LUCID account of the ZSVR.

At Kaufland.de, you can benefit from our packaging licensing partner Lizenzero and get an exclusive 10 percent discount on your annual license fee as a Kaufland.de seller!

In just a few steps, Lizenzero enables sellers to implement their system participation obligations within the packaging law on an international level in a simple and straightforward manner. You can find more information about our partner here.

As of 1st January 2022, sellers of electrical and electronic goods on Kaufland.de have been obliged to offer customers the opportunity to take back or return old appliances free of charge via Kaufland.de.

You can find more information about the Electrical and Electronic Equipment Act and the associated take-back obligations for sellers on Kaufland.de here.

1. Check to determine whether you are considered a "producer" within the meaning of the ElektroG.

Registration obligation applies:

1.1 Please register with stiftung ear without undue delay.

a. Sellers with a German branch can register with stiftung ear.

b. Sellers without a German branch are required to have the registration with stiftung ear carried out with the assistance of an authorized representative. The authorized representative assumes responsibility for fulfilling your registration obligations in Germany. Further information is available here.

1.2 Enter your WEEE registration number in your seller account in the Seller Portal. We will notify you as soon as this function is activated.

No registration obligation applies:

1.1 Go to the stiftung ear List of registered producers and authorized representatives and check without undue delay whether your producer, interim supplier from Germany or your authorized representative has already registered the product you have placed on the market and has the respective WEEE registration numbers (for each brand and type of equipment) available.

a. If this is the case, enter the WEEE registration numbers of your producer, interim supplier or authorized representative in your seller account in the Seller Portal.

b. We will notify you as soon as this function is activated.

1.2 If no WEEE registration numbers of your producer, interim supplier or authorized representative exist:

a. Please register with stiftung ear without undue delay.

b. Enter your WEEE registration numbers in your seller account in the Seller Portal. We will notify you as soon as this function is activated.

Please note that the term "producer" under the ElektroG is a blanket term that covers various groups obligated to register, including sellers.

| Sellers | The blanket term "producer" under the ElektroG also includes retailers, i.e., sellers who offer electrical and electronic equipment for sale. sellers will be obligated to register with stiftung ear themselves whenever the equipment they placed on the market has not already been registered in advance by the German or foreign producer or the authorized representative. |

| Producer | is a person who produces electrical or electronic equipment under their name, or own brand, or has them designed or produced and offers them under their name or brand in Germany. |

| Client of a production | is a person who offers electrical and electronic equipment from other producers under their own name or brand in Germany, or resells these commercially. Please note: The supplier or reseller is not regarded as the producer if the name and/or brand of the producer appears on the electrical and electronic equipment. |

| Importer | is a person who offers electrical and electronic equipment that does not originate from Germany – but from a third country or another EU member state – for the first time on the German market. |

| Exporter | is a person who offers electrical and electronic equipment by means of distance communication directly to end users and is not situated in Germany. |

1. Check to determine whether you are considered a "producer" within the meaning of the BattG.

Registration obligation applies:

1.1 Please register with stiftung ear without undue delay.

a. Sellers with a German branch can register with stiftung ear.

b. Sellers without a German branch are required to have the registration with stiftung ear carried out with the assistance of an authorized representative. The authorized representative assumes responsibility for fulfilling your registration obligations in Germany. Further information is available here.

1.2 Enter your BattG registration number in your seller account in the Seller Portal. We will notify you as soon as this function is activated.

No registration obligation applies:

1.1 Go to the stiftung ear List of registered producers and authorized agents and check without undue delay whether your producer, interim supplier from Germany or your authorized agent has already registered the product you have placed on the market and has the respective BattG registration numbers (for each brand and type of equipment) available.

a. If this is the case, enter the BattG registration numbers of your producer, interim supplier or authorized agent in your seller account in the Seller Portal.

b. We will notify you as soon as this function is activated.

1.2 If no BattG registration numbers of your producer, interim supplier or authorized agent exist:

a. Please register with stiftung ear without undue delay.

b. Enter your BattG registration numbers in your seller account in the Seller Portal. We will notify you as soon as this function is activated.

As of 1st July 2022, a new regulation for distributors of packaging in Slovakia has been in force. Sellers who place packaging on the market in Slovakia are required to register with the Slovak Ministry of Environment. As in Germany, sellers in Slovakia are responsible for the exact amount of packaging they ship to end users.

In addition to the obligation to register, Sellers are also obliged to join a dual system in Slovakia. The dual system helps sellers in Slovakia to gradually make their packaging more recyclable and to license it. You proceed as follows:

a. Licensing: Sellers with a Slovak branch conclude a license agreement with a Slovak dual system (Organizácie zodpovednosti výrobcov (OVZ)). You can find an overview of the official OVZ here.

b. Data reporting: You report the packaging quantities you put on the market in your dual system.

c. Authorised representative: If you do NOT have a Slovakian branch, you are obliged to carry out the registration listed above via an authorised organisation (OVZ). You can find out more here.

Sellers who sell electrical and electronic items from the affected categories via Kaufland.sk are obligated to offer customers a free take-back or return option via Kaufland.sk.

Further information about the Electrical and Electronic Equipment Act and the associated take-back obligations for sellers will be available here soon.

Sellers who sell electrical and electronic items on Kaufland.sk, respectively all distributors of electrical and electronic goods from these categories, are obliged to fulfill their ElektroG registration obligations in Slovakia before placing electrical goods on the market in this country.

a. Sellers who have a Slovakian branch register with the Slovakian Ministry of Environment. More information here.

b. Sellers without a Slovak branch are obliged to carry out the above registration through a Slovak authorised representative (Organizácie zodpovednosti výrobcov (OZV)). More information here.

This registration obligation exists for every Seller and Manufacturer. It is not possible to register multiple people at once.

Sellers, respectively all distributors of portable, automotive and industrial batteries from these categories, who sell items in Slovakia that are covered by the European Battery Act, are obliged from 2023 onwards to comply with their Battery Act registration obligations in Slovakia as well. This means that they will have to register with the Slovak Ministry of Environment before they are allowed to place batteries on the market in Slovakia.

a. Sellers who have a Slovak branch register with the Slovak Ministry of Environment. You can find more information here.

b. Sellers without a Slovak branch are obliged to perform the above registration through a Slovak authorised representative (Organizácie zodpovednosti výrobcov (OZV)). You can find more information here.

As of 1st July, 2022, a new regulation for distributors of packaging in the Czech Republic has been in force. Online sellers as well as manufacturers who place packaging on the market in the Czech Republic are required to register with the recycler EKO-KOM, which operates throughout the Czech Republic. Licensing and data reporting are also handled by EKO-KOM. You can find more information here.

Sellers who sell electrical goods from the affected categories via Kaufland.cz are obliged to offer customers a free take-back or return option via Kaufland.cz.

Further information on the Electrical and Electronic Equipment Act and the associated take-back obligations for Sellers will be available here soon.

Sellers who sell electrical appliances on Kaufland.cz and all distributors of electrical and electronic products from these categories are obliged to fulfill their ElektroG registration obligations in the Czech Republic before placing electrical appliances on the market in this country.

a. Sellers with a Czech branch register with the Czech Ministry of Environment. You can find more information here.

b. Sellers without a Czech branch are obliged to have the above-mentioned registration carried out by a Czech authorised representative or by a dual system. You can find more information here.

This registration obligation exists for every seller and manufacturer. It is not possible to register multiple people at once.

As of 2023, sellers, or all distributors of portable, automotive and industrial batteries from these categories, who sell items in the Czech Republic that fall under the European BattG, are required to meet their BattG registration obligations in the Czech Republic as well. This means that they must register with the Czech Ministry of Environment before they are allowed to place batteries on the market in the Czech Republic.

a. Sellers who have a Czech branch office register with the Czech Ministry of the Environment. You can find out more information here.

b. Sellers without a Czech branch are obliged to have the above-mentioned registration carried out by an authorised representative or by a dual system. You can find more information here.

In accordance with the Austrian Packaging Ordinance (Verpackungsverordnung – VVO), sellers or "primary obligated parties" who place packaging on the market to end consumers in Austria must register on the EDM portal (see edm.gv.at) Once you complete the registration process, you will receive your individual GLN..

In addition, sellers are obligated to licence the packaging placed on the market and participate in an approved collection and recycling system. You can find a list of approved collection and recycling systems here.

You can find more information here.

Sellers with no registered office or branch in Austria

With effect from 1st January 2023, sellers with no registered office or branch in Austria have been required to appoint an authorised representative responsible for fulfilling the obligations under the Austrian Packaging Ordinance. The appointment is made by means of a notarised power of attorney in German or English. In such case, the authorised representative will complete the registration process on the EDM portal, after which you will receive your individual GLN.

Please note that the appointment of an authorised representative and any changes to or revocation of any authorisation will only take effect when the calendar quarter ends. You can find more information on authorised representatives here.

Do you require an authorised representative for Austria? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Austria. You can find more information here.

In accordance with the Austrian Packaging Ordinance (Verpackungsverordnung – VVO), sellers or distributors of single-use plastic products who place single-use plastic packaging or products on the market to end consumers in Austria must register on the EDM portal (see edm.gv.at). Once you successfully complete the registration process, you will receive your individual GLN..

In addition, there is an obligation to licence the single-use plastic products placed on the market and participate in an approved collection and recycling system. . You can find a list of approved collection and recycling systems here. hier.

You can find more information here.

Sellers with no registered office or branch in Austria

With effect from 1st January 2023, sellers with no registered office or branch in Austria have been required to appoint an authorised representative responsible for fulfilling the obligations under the Austrian Packaging Ordinance. The appointment is made by means of a notarised power of attorney in German or English. In such case, the authorised representative will complete the registration process on the EDM portal, after which you will receive your individual GLN.

Please note that the appointment of an authorised representative and any changes to or revocation of any authorisation will only take effect when the calendar quarter ends.

You can find more information on authorised representatives here.

Do you require an authorised representative for Austria? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Austria. You can find more information here.

Yes, sellers/manufacturers commercially importing importing electrical and electronic equipment from one of these categories to Austria under the Austrian Waste Electrical and Electronic Equipment Ordinance (Elektroaltgeräteverordnung – EAG-VO) legally qualify as manufacturers and must fulfil the obligations of equipment manufacturers.

Therefore, as a seller, you are required to register on the EDM portal (see edm.gv.at). Once you successfully complete the registration process, you will receive your individual GLN..

In addition, sellers are obligated to licence the electrical and electronic equipment placed on the market and participate in an approved collection and recycling system. You can find a list of approved collection and recycling systems for waste electrical and electronic equipment (WEEE) here.

You can find more information on all further obligations here.

Sellers with no registered office or branch in Austria

With effect from 1st January 2023, sellers with no registered office or branch in Austria have been required to appoint an authorised representative responsible for fulfilling the obligations under the Austrian Waste Electrical and Electronic Equipment Ordinance. The appointment is made by means of a notarised power of attorney in German or English. In such case, the authorised representative will complete the registration process on the EDM-Portal, after which you will receive your individual GLN.

Please note that the appointment of an authorised representative and any changes to or revocation of any authorisation will only take effect when the calendar quarter ends.

You can find more information on authorised representatives here.

Do you require an authorised representative for Austria? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Austria. You can find more information . here here.

Sellers that sell electrical and electronic equipment from the relevant equipment categories on Kaufland.at are required to offer customers free WEEE take-back or a return option via Kaufland.at.

You can find more information on the Austrian Waste Electrical and Electronic Equipment Ordinance and the associated take-back obligations for sellers here.

Yes, sellers/manufacturers commercially importing batteries from one of these categories to Austria under the Austrian Batteries Ordinance legally qualify as manufacturers and must fulfil the obligations of the equipment manufacturers.

Therefore, as a seller, you are required to register on the EDM portal (see edm.gv.at. Once you successfully complete the registration process, you will receive your individual GLN. .

In addition, sellers are obligated to licence the electrical and electronic equipment placed on the market and participate in an approved collection and recycling system. . You can find a list of approved collection and recycling systems for batteries here.

You can find more information on all further obligations here.

Sellers with no registered office or branch in Austria

With effect from 1st January 2023, sellers with no registered office or branch in Austria have been required to appoint an authorised representative responsible for fulfilling the obligations under the Austrian Waste Electrical and Electronic Equipment Ordinance. The appointment is made by means of a notarised power of attorney in German or English. In such case, the authorised representative will complete the registration process on the EDM-Portal after which you will receive your individual GLN.

Please note that the appointment of an authorised representative and any changes to or revocation of any authorisation will only take effect when the calendar quarter ends.

You can find more information on authorised representatives here.

Do you require an authorised representative for Austria? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Austria. You can find more information here.

In order to sell on Kaufland.at, you must provide the following information in the EPR-Compliance area for Austria.

Sellers with their registered office or a branch in Austria

1. Your GLN from the EDM portal/p>2. Confirmation of compliance with your obligations per check box: "I hereby confirm with binding legal effect that, if the respective products are placed on the market in Austria, I, as manufacturer or primary obligated party, will comply with the requirements of section 13a (1) of the Austrian Waste Management Act (Abfallwirtschaftsgesetz – AWG) and the respective requirements of the corresponding ordinance under section 14 (1) AWG regarding collection and recycling under section 13a (3) and (4) AWG and the obligation to participate in a collection and recycling system under 13g (2) AWG as amended. I undertake to notify the marketplace operator without undue delay if the aforementioned requirements cease to apply."

Sellers with no registered office or branch

1. Your GLN from the EDM portal

2. Company name of your authorised representative

3. Confirmation of compliance with your obligations per check box: "I hereby confirm with binding legal effect that, if the respective products are placed on the market in Austria, I, as manufacturer or primary obligated party, will comply with the requirements of section 13a (1) of the Austrian Waste Management Act (Abfallwirtschaftsgesetz – AWG) and the respective requirements of the corresponding ordinance under section 14 (1) AWG regarding collection and recycling under section 13a (3) and (4) AWG and the obligation to participate in a collection and recycling system under 13g (2) AWG as amended. I undertake to notify the marketplace operator without undue delay if the aforementioned requirements cease to apply."

New rules have been in force since 1st January 2020 which apply to distributors of packaging in Poland. Online sellers who place packaging on the market in Poland are required to register in the BDO register before commencing their activities in Poland. As in Germany, sellers in Poland are responsible for the exact quantity of packaging they ship to end consumers. Registration must be submitted in Polish, and processing can take up to 12 weeks. Once you complete the registration process, you will receive your BDO number. You can find more information on the registration requirement here.

Sellers with no registered office or branch in Poland

Since 1st January 2020, sellers with no registered office or branch in Poland have been required to have an authorised representative complete the registration in the BDO register on their behalf. Once the authorised representative completes the registration process, you will receive your BDO number. You can find more information on the authorised representative here.

Do you require an authorised representative for Poland? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Poland. You can find more information here.

New rules have been in force since 1st January 2020 which apply to distributors of single-use plastic products in Poland. Online sellers who place single-use plastic products on the market in Poland are required to register in the BDO register before commencing their activities in Poland. Registration must be submitted in Polish, and processing can take up to 12 weeks. Once you complete the registration process, you will receive your BDO number. You can find more information on the registration requirement here.

Sellers with no registered office or branch in Poland

Since 1st January 2020, sellers with no registered office or branch in Poland have been required to have an authorised representative complete the registration in the BDO register on their behalf. Once the authorised representative completes the registration process, you will receive your BDO number. You can find more information on the authorised representative here.

Do you require an authorised representative for Poland? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Poland. You can find more information here.

In addition to registering in the BDO register and submitting the corresponding annual quantity reports, sellers are required to pay a contribution to fulfil the recycling quotas prescribed by law. This can be done either by paying a fee to the BDO or by participating in a waste recovery system that fulfils the sellers' statutory requirements for the collection and recycling of packaging waste.

Please consult with your authorised representatives to determine the procedure most appropriate for you.

Sellers that sell electrical and electronic equipment from the relevant equipment categories on Kaufland.pl are required to offer customers free WEEE take-back or a return option via Kaufland.pl.

With effect from 1st January 2020, new rules apply to distributors of electrical and electronic equipment in Poland. Online sellers who place electrical and electronic equipment on the market in Poland are required to register in the BDO register before commencing their activities in Poland. Registration must be submitted in Polish, and processing can take up to 12 weeks. Once you complete the registration process, you will receive your BDO number. You can find more information on the registration requirement here.

Sellers with no registered office or branch in Poland

Since 1st January 2020, sellers with no registered office or branch in Poland have been required to have an authorised representative complete the registration in the BDO register on their behalf. Once the authorised representative completes the registration process, you will receive your BDO number. You can find more information on the authorised representative here.

Do you require an authorised representative for Poland? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Poland. You can find more information here.

With effect from 1st January 2020, new rules apply to distributors of batteries in Poland. Online sellers who place batteries on the market in Poland are required to register in the BDO register before commencing their activities in Poland. Registration must be submitted in Polish, and processing can take up to 12 weeks. Once you complete the registration process, you will receive your BDO number. You can find more information on the registration requirement here.

Sellers with no registered office or branch in Poland

Since 1st January 2020, sellers with no registered office or branch in Poland have been required to have an authorised representative complete the registration in the BDO register on their behalf. Once the authorised representative completes the registration process, you will receive your BDO number. You can find more information on the authorised representative here.

Do you require an authorised representative for Poland? Our service partner take-e-way can provide you comprehensive support as your authorised representative in Poland. You can find more information here.

You can provide the following information in the EPR-compliance area for Poland:

Sellers with their registered office or a branch in Poland

1. Your BDO number from the BDO register

Sellers with no registered office or branch

1. Your BDO number from the BDO register

2. Company name of your authorised representative

Please note: Sellers under the "deemed supplier" model are required to provide the BDO number.

If you purchase your goods from a supplier or manufacturer in Germany, then the products or brands are covered by the WEEE number of the supplier or manufacturer and you have to provide these number(s) in the Seller Portal. If you are the first and only one to offer given products or brands in Germany, you need to register with stiftung ear yourself (Only possible for sellers with a German branch. Sellers without a German branch are required to have the registration with stiftung ear carried out with the assistance of an authorized representative).

One WEEE number cannot be saved multiple times in the Seller Portal. In this case, the error message "duplicate" is displayed. When you sell several brands, it can happen that the saved WEEE number is valid for those several brands. In this case you only need to submit your WEEE number once.

You can find an overview of the affected device categories here.

Please inform us of the affected item by contacting your personal Account Manager or our Seller Support. We will then check whether the affected item has been incorrectly assigned.

Please ensure that you save all WEEE numbers for all electrical or electronic equipment affected by the ElektroG that you sell on Kaufland.de in your Seller Portal. This includes your own registration number as well as the numbers from your suppliers or manufacturers. If there are still irregularities, please contact our Seller Support or your personal Account Manager.

This can have several reasons. The most common ones are sometimes:

If you do not enter valid WEEE numbers for your offers affected by the ElektroG and BattG by 1st July 2023, your offers will be hidden on 1st July 2023 and will not be activated until the corresponding WEEE number(s) have been entered and verified.

Please check your exact registration obligations via the ear foundation here. Make sure to consider all obligated party combinations.

For example.

Do you purchase your goods from a supplier or manufacturer in Germany?

Are the products or brands you sell already covered by the supplier's or manufacturer's WEEE number?

In these cases you also need to enter the relevant WEEE number(s) in the Seller Portal.

If you are the first and only seller of certain products or brands in Germany, you have to register yourself with stiftung ear. (Only possible for sellers with a German branch. Sellers without a German branch must register with stiftung ear with the help of an authorized representative).

No, an extension of the deadline is not possible. Submit your registration application to the stiftung ear now and enter your WEEE numbers in the Seller Portal as soon as possible - only after subsequent verification will your hidden offers become active again.

No. As a marketplace, we are also subject to the legal inspection obligations according to ElektroG and BattG and. If sellers cannot produce valid registration numbers for the devices they sell which are affected by the ElektroG after 1st July 2023, then no further sales of these offers may be made on Kaufland.de.

You do not need to enter the same WEEE numbers more than once.

If you sell multiple brands, it is possible that the WEEE number you have already stored is valid for these multiple brands and equipment categories. In this case, you only need to submit your WEEE number once. However, if you are adding listings of other appliance categories and brands for which the WEEE number(s) you have already entered are not valid, then you must enter a valid WEEE number here for the new listings.

1. Please refer to the relevant information in our Seller Guidelines and our Seller Terms and Conditions..

2. As a seller, you are responsible for invoicing the end customer.

For Poland: Please note that you must include your BDO number on your invoices in Poland.

Do I have to issue invoices to customers in the respective language of the country of sale?

It is not absolutely necessary to issue customer invoices in the national language. However, please bear in mind that local authorities may request all invoices in the local language in the event of an audit.

Note: If the "deemed supplier" model applies (you can find more information on our Info page on the EU Tax Directive 2021)), invoices for orders will be sent to end customers by Kaufland Global Marketplace. Invoices issued by Kaufland Global Marketplace are always in the national language.

You remain the counterparty to the transactions with your customers and are responsible for product liability and warranty claims, just like you are now.

Note: Correct tax rates

You are required to state the tax rate shown on the invoice in accordance with the VAT laws of the country in which your customer is based.

The recycling fee is an advance disposal fee for electrical and electronic equipment that can be charged to the customer.

As a seller, you are responsible for invoicing end customers in Germany, Slovakia and the Czech Republic (except in the case of the "Deemed Supplier Model"). Please note that you are also required to show the costs for recycling your electrical and electronic equipment (EEE) as a "recycling fee" on the invoice.

Am I allowed to advertise my own store on the invoice?

Apart from the business details required by law, your invoice must not contain any other web addresses or links to your own shop.

When sellers in Germany, Slovakia or the Czech Republic sell their goods to end customers, they have to pay sales tax. This can vary from country to country.

If sellers sell to an end customer

The decisive factor is therefore where the end customer is located and where the sellers deliver. The seller is responsible for invoicing.

To do this, use our partner Hellotax, who will help you to automate your tax issue professionally and efficiently. You can find more information about our partner here.

There are different tax rates for value added tax (= sales tax) in Germany:

The tax rates for Germany are set out in the Value Added Tax Act in § 12 UStG.

There are different tax rates for value added tax (= sales tax) in Slovakia:

You can find out more information about the Slovak VAT system on the Slovak Ministry of Finance website.

There are different tax rates for value added tax (= sales tax) in the Czech Republic:

You can find out more information about the Czech VAT system on the Czech Ministry of Finance website.

There are different tax rates for VAT in Austria:

You can find more information on the Austrian VAT system here.

There are different tax rates for VAT in Poland:

You can find more information on the Polish VAT system here.

On 1 January 2023, the German Platform Tax Transparency Act (Plattformen-Steuertransparenzgesetz – PStTG) entered into force. Under the new legislation, which transposes the EU DAC 7 Directive into national law, marketplace operators are required to report extensive information on sales made by sellers registered after 1 January 2023 to EU tax authorities. Details are available here.

The PStTG applies to all sellers with a head office or a tax residency within the EU.

The following information must be reported in your seller account in the Seller Portal:

Kaufland Global Marketplace is required by law to collect the tax identification number (TIN) and/or tax number as part of the mandatory reported data.

A tax identification number (TIN) serves to identify the taxpayer. The taxpayer is registered with the tax office under this number.

In Germany, the following numbers constitute a tax identification number (TIN):

The table below shows the names commonly used to designate tax identification numbers (TIN) in other EU member states.

Source: https://www.oecd.org/tax/automatic-exchange/crs-implementation-and-assistance/tax-identification-numbers/

| Country | Known as | TIN - Natural person | TIN - Entity |

|---|---|---|---|

| Austria | Tax Identification Number | 9 digits | 9 digits |

| Belgium | National Number

Business Identification Number Belgian Company Number |

11 digits | 10 digits |

| Bulgaria | Unified Civil Number Personal Foreigner's Number Unified Identification Code Unified Identification Code of BULSTAT |

10 digits | 9 digits |

| Croatia | Personal Identification Number | 11 digits | 11 digits |

| Republic of Cyprus | Tax Identification Code | 8 digits + 1 letter | 8 digits + 1 letter |

| Czech Republic | Personal Identification Number | 9 or 10 digits | “CZ” + 8 digits to 10 digits |

| Denmark | Central Person Registration Number CVR Number SE Number |

10 digits | 8 digits |

| Estonia | Personal Code Unique Registration Code |

11 digits | 8 digits |

| Finland | Social Security Number Business Identity Code |

6 digits + (+ or - or “A”) + 3 digits + 1 digit or letter | 7 digits + “-” + 1 digit |

| France | Tax Identification Number SIREN Business identification Number |

13 digits (first digit is always 0, 1, 2, or 3) | 9 digits |

| Germany | Identification Number Tax Number Tax Identification Number |

11 digits | 10 to 13 digits |

| Greece | Tax Identification Number | 9 digits | 9 digits |

| Hungary | Tax Identification Number Tax Number |

10 digits | 11 digits |

| Ireland | Personal Public Service Number Tax Reference Number CHY Number |

7 digits + 1 letter 7 digits + 2 letter |

7 digits + 1 letter 7 digits + 2 letter “CHY” + 1 to 5 digits |

| Italy | Fiscal Code Tax Identification Number |

6 letter + 2 digits + 1 letter + 2 digits + 1 letter + 3 digits + 1 letter | 11 digits |

| Latvia | Personal Identity Number Tax Identification Number |

11 digits | „9000“ + 7 digits „4000“ + 7 digits „5000“ + 7 digits |

| Lithuania | Tax Identification Number Tax Registration Number |

10 digits or 11 digits | 9 digits or 10 digits |

| Luxembourg | National Identification Number National Identifier |

13 digits | 11 digits |

| Malta | Identity Card Number Unique Taxpayer Reference Number |

7 digits + 1 letter 9 digits |

9 digits |

| Netherlands | Tax Identification Number | 9 digits | 9 digits |

| Poland | Polish Resident Identification Number Tax Identification Number |

10 to 11 digits | 10 digits |

| Portugal | Tax Identification Number | 9 digits | 9 digits |

| Romania | Tax Identification Number | 13 digits | 2 to 10 digits |

| Slowakei | Tax Identification Number Unique Personal Identification Number |

10 digits | 10 digits |

| Slovenia | SI Tax Number | 8 digits | 8 digits |

| Spain | National Identification Document Foreigner Identification Document Tax Identification Number |

8 digits + 1 letter „L“ + 7 digits + 1 letter „K“ + 7 digits + 1 letter „X“ + 7 digits + 1 letter „Y“ + 7 digits + 1 letter „Z“ + 7 digits + 1 letter „M“ + 7 digits + 1 letter |

1 letter + 8 digits 1 letter + 7 digits + 1 letter |

| Schweden | Social Security Number Co-ordination Number Organization Number |

10 digits | 10 digits |

No.

These are different numbers. The tax identification number is issued by the Federal Central Tax Office (Bundeszentralamt für Steuern – BZSt), the tax number is issued by the appropriate local tax office (Finanzamt) and the commercial register number by the appropriate registry court (Registergericht).

No.

The tax identification number (TIN) and the VAT identification number (VAT ID number) are different numbers.

Just like the product data sheets, energy labels for electronic products must also be written in the corresponding national language. Please translate the corresponding energy labels of your affected products into the respective national language of the country of sale.

If there is no or an incorrect energy label, we reserve the right to take the products offline.

Kaufland Global Marketplace offers you a free product data translation. You can have your existing product data translated automatically. You can make any changes afterwards at any time.

In addition to our automated product data translation, our partner Powerling offers you a translation service - from post-editing to editing by professional translators. You can find more information about Powerling here.

CE-markings are used to declare that their products comply with European directives and standards. It is mandatory that the document is signed by the seller/manufacturer or the authorised representative. If a seller/manufacturer fails to obtain the EU Declaration of Conformity for the respective product, heavy fines may be imposed.

The declarations must be written in the appropriate language of the country of sale.

Our partner Powerling will be happy to support you with various translation services. You can find more information about our partner here.

If the CE-marking is missing or incorrect, Kaufland Global Marketplace reserves the right to hide your offers.

The European Commission provides the European Online Dispute Resolution (ODR) platform to make online shopping safer and fairer. Online sellers operating in the EU are obliged to provide the following data:

a. You must provide a link to the online dispute resolution platform. This link must be accessible.

Example text for the link: "Under current law, we are obliged to inform consumers about the existence of the European Online Dispute Resolution Platform. This can be used to resolve disputes without having to go to court. The European Commission is responsible for setting up the platform. You can find the European Online Dispute Resolution Platform here: https://ec.europa.eu/consumers/odr/."

b. You must clearly indicate whether you agree or refuse to participate in a dispute resolution procedure.

Example text: "We are willing/not willing to participate in dispute resolution proceedings before a consumer arbitration board."

This information must be saved for each Kaufland marketplace under Legal texts/Additional contacts.

If no information is available on the European Platform for Online Dispute Resolution, Kaufland Global Marketplace reserves the right to hide your offers.

Biocidal products may only be offered on the Kaufland marketplaces if a registration number is available for the corresponding offers and is displayed when the offer is made.

Each biocidal product must be registered separately in each country of sale and is assigned its own registration number, which you must save in the corresponding product categories as a new attribute "Registration number biocidal products". You can submit the information in your product data via the attribute "biocide_number".

If the registration number is not submitted correctly, Kaufland Global Marketplace reserves the right to hide your offers.

Permissible bundles are offers that contain a combined, value-added offer of at least two different products that are offered at a total price.

Example of permissible bundles: pot set consisting of four pots of different sizes.

Example of non-permissible bundles: smartphone with the addition of a transparent cover.

If product bundles do not meet the requirements set above, Kaufland Global Marketplace reserves the right to block any offers.

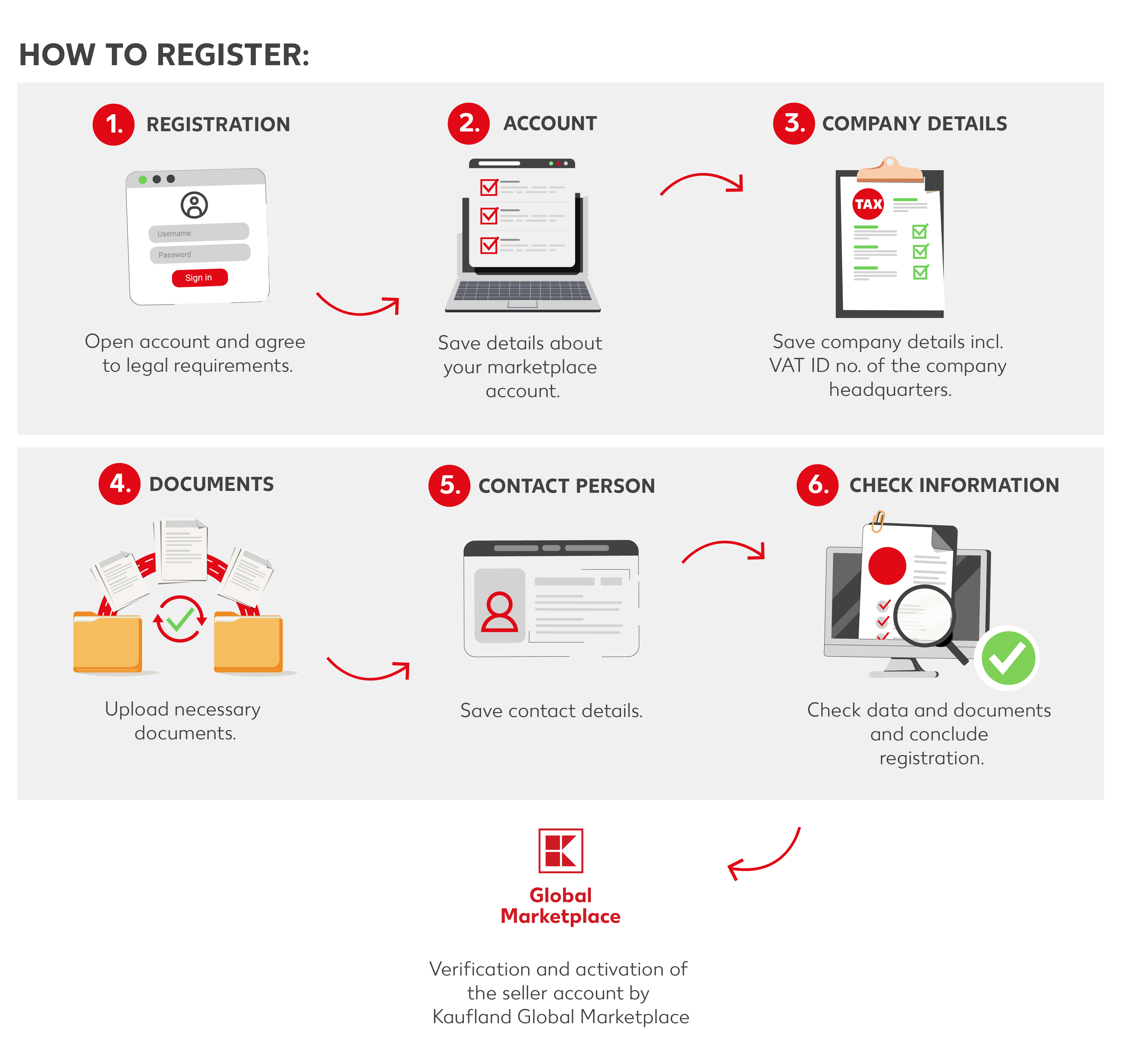

To sell with Kaufland Global Marketplace, you need the following documents for the registration process:

The registration process for selling with Kaufland Global Marketplace is very simple. You will be guided step by step through the registration process.

You open your seller account, save the required information and upload the relevant documents. After completing the registration, Kaufland Global Marketplace will check your data and activate your account within three working days.

During registration you need to make the following settings: