Infopage New EU VAT Regulation 2021

Dear Seller,

On 1 July 2021, the countries of the European Union (EU) will introduce a new VAT regulation for e-commerce ("EU Digital Package 2021") which will affect your sales of goods to EU consumers via online marketplaces and therefore also via Kaufland.de.

The aim of the new regulations is to modernize the VAT rules on cross-border e-commerce sales:

Online sellers and marketplaces are thus facing far-reaching changes that will require the conversion of processes and billing methods by July 1, 2021.

For the upcoming amendments on July 1, 2021, we have summarized the most important changes for you below. The basic procedures will not change for you. We will provide you with the same services at the conditions you are familiar with.

- Who is affected by the changes?

- What will change from July 1, 2021?

- What do you need to do?

- Webinar dates

- Frequently asked questions

We will also regularly update this infopage with further relevant information for you.

Who is affected by the changes on July 1, 2021?

Please note that you are only directly affected by this new regulation if one of the following conditions applies to you:

The changes are not relevant for you if your company headquarters is in Germany, you do not ship products from outside of the EU and you sell exclusively to customers in Germany.

What will change from July 1, 2021?

If the changes are relevant for you, there will be a lot of amendments for you as a result of the EU's Digital Package 2021 coming into force on July 1, 2021. We have summarized the main changes for you in a short video and in detail below:

Significant changes as of 1 July 2021

1. Kaufland.de will be considered a "Deemed Supplier" in the following situations and will be obliged to calculate and pay VAT on B2C sales of goods on Kaufland.de.

→ You are affected by this change if you have the following transactions for B2C sales on Kaufland.de:

2. Existing country-specific delivery thresholds for distance sales of goods within the EU will be abolished and replaced by a new EU-wide threshold of 10,000 euros. If you have exceeded the delivery threshold you will be subject to registration in every member state in which you make distance sales.

→ Based on operational decisions, we will treat sellers who fall below the new delivery threshold in the same way as those who fall above it.

3. Introduction of the special reporting procedure "One-Stop-Shop" (OSS) which enables sellers to centrally pay VAT on their distance sales throughout the EU with a single VAT registration application. In this way, registration in several EU member states can be avoided. Independently of this regulation, the German VAT Act in 22f (1) No. 3 requires the application of a German VAT ID for all sellers who sell goods to German end customers.

An exception applies to sellers based in the EU who use the OSS procedure. This means that you can either submit a German VAT ID and a German tax number in the seller portal on Kaufland.de, or you use the OSS and submit the VAT ID of the Member State in which you have registered in the OSS.

→ Please note that this is an update and we are currently working at full speed on the technical implementation. The submission of information in the case of OSS is expected to be possible from CW 25 in your seller account.

4. Abolition of the import VAT exemption for import of goods with a value of up to 22 euros which makes all consignments of goods subject to import VAT from 1 July 2021. Through the new "Import-One-Stop-Shop" (IOSS) procedure, consignments of goods with a value of up to 150 euros can be exempted from import VAT in the future. Further details on provision and use will follow.

→ You are affected by the change if you import goods into the EU and if the value of the consignment does not exceed 150 euros.

What will change for sellers after July 1 in case a "Deemed Supplier" model applies?

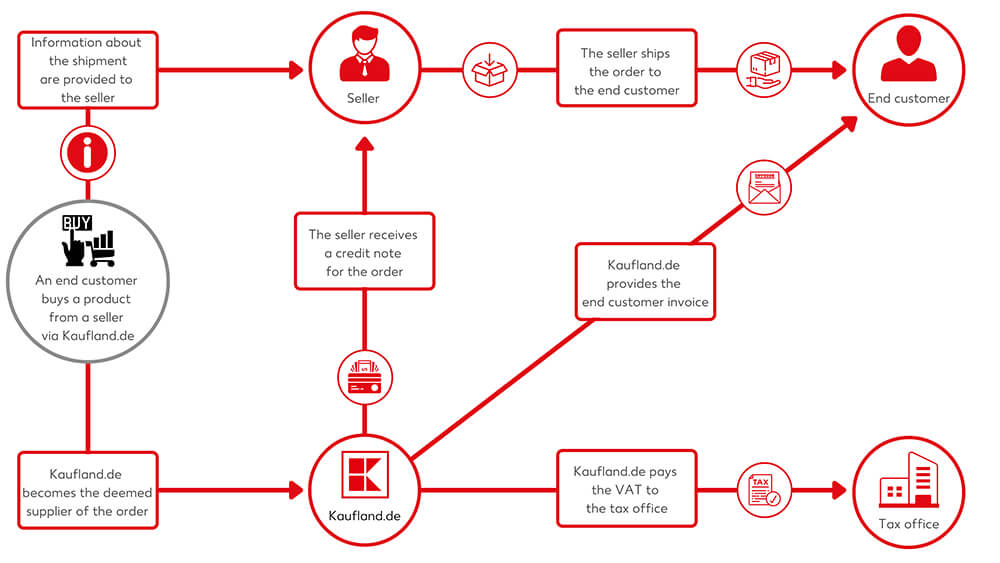

Kaufland.de will be treated under a legal fiction as if the online marketplace itself had purchased the goods from the online seller and delivered them to the end customer.

This new procedure involves some changes with regards to billing documents (vis-à-vis you and the end customer) and the commissioning or shipping of the goods:

Please note that these changes have no impact on transactions outside the "Deemed Supplier" model. Here, there are no changes with regard to the currently applicable requirements for the deduction of VAT.

We have summarized the main changes for you in a short video and in detail below:

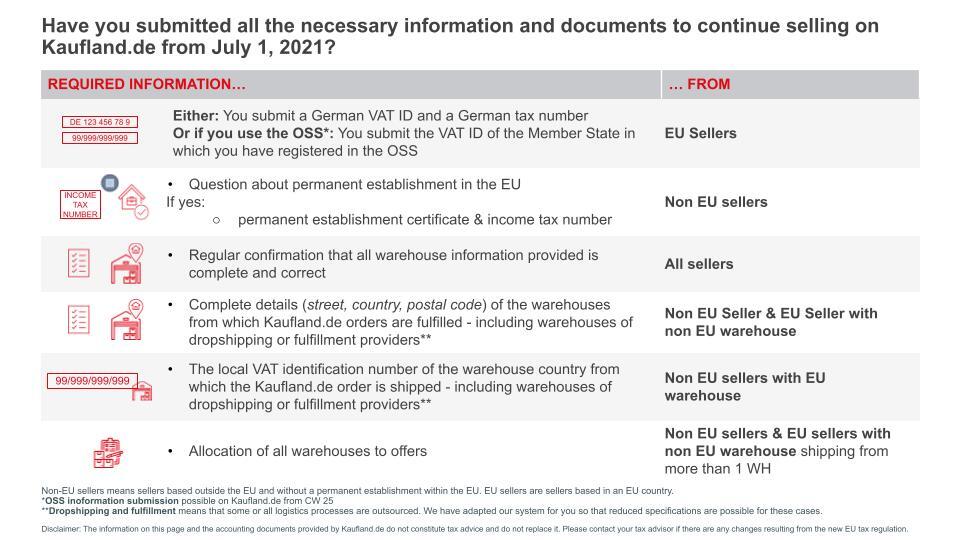

What do you need to do?

As a marketplace, Kaufland.de requires additional information from you as a basis for paying the VAT and for creating the accounting documents in the "Deemed Supplier" Model. To keep the effort on your side as low as possible, we have linked the requirements in the Seller Portal to your company headquarters:

HQ registered outside the EU:

HQ registered within the EU:

From CW 22 you can enter the details in your Kaufland.de seller account. Make sure that you have entered the data completely and correctly by 16 June 2021. If no updates are made by 1 July 2021, we reserve the right to hide your offers on Kaufland.de.

Frequently asked questions

-

What changes will the 2021 VAT digital package bring?

1. Abolishment of country-specific thresholds

Until now, for deliveries to other EU countries, you had to register according to tax law in that member state if you exceeded the country-specific delivery threshold. These thresholds used to vary widely from one EU country to another, ranging from 35,000 to 100,000 euros. In the future, a uniform threshold of 10,000 euros will apply within the EU. If you have exceeded the delivery threshold of 10,000 euros for the total of your distance sales within the EU, you will be subject to registration in every member state in which you make distance sales.

*Distance sales of goods refers to distance selling of goods within the EU and distance selling of goods imported from third territories or third countries.

2. Introduction of the „One-Stop-Shop“ (OSS) procedure

The "One-Stop-Shop" (OSS) reporting procedure allows you to centrally pay VAT on your distance sales of goods throughout the EU as part of a single VAT return. This means that registration in several member states can be avoided. The main change in the OSS procedure is that more types of sales can be reported than before and that you will also be able to report your distance sales of goods (formerly mail order) in the OSS procedure from July 1, 2021.

Please note however, that the German VAT Act has defined stricter obligations for online marketplaces in §22f (1) No. 3 and requires the recording of a German VAT ID for all sellers selling goods to German end customers. An exception applies to sellers based in the EU who use the OSS procedure. This means that you can either submit a German VAT ID and a German tax number in the seller portal on Kaufland.de, or you use the OSS and submit the VAT ID of the Member State in which you have registered in the OSS.

→ Please note that this is an update and we are currently working at full speed on the technical implementation. The submission of information in the case of OSS is expected to be possible from CW 25 in your seller account.

3. New procedure for imports up to 150 euros

The previously applicable exemption from import VAT on the import of goods with a value of up to 22 euros will be abolished without replacement, meaning that all consignments of goods will be subject to import VAT from July 1, 2021. Through the new "Import-One-Stop-Shop" (IOSS) procedure, consignments of goods up to 150 euros can be exempted from import VAT in the future. For this purpose, Kaufland.de provides you with the internal IOSS number. If this number is entered when importing consignments of goods up to 150 euros, no import VAT will be charged on the consignment. Further details on the provision and use of the IOSS number will follow here shortly. This regulation is only relevant for you if you import goods from outside the EU and send goods to end customers within the EU.

4. The „Deemed Supplier" model or sales of goods via online marketplaces

A fundamental change is the "Deemed Supplier" model introduced by the VAT regulation. This change represents the most extensive change in the new EU VAT regulation. It means far-reaching changes for online sellers and marketplaces, which will require the conversion of processes and accounting methods by July 1, 2021.

More details on this topic can be found under the next questions.

Source: https://ec.europa.eu/taxation_customs/business/vat/vat-e-commerce_en

-

What is the “Deemed Supplier” model?

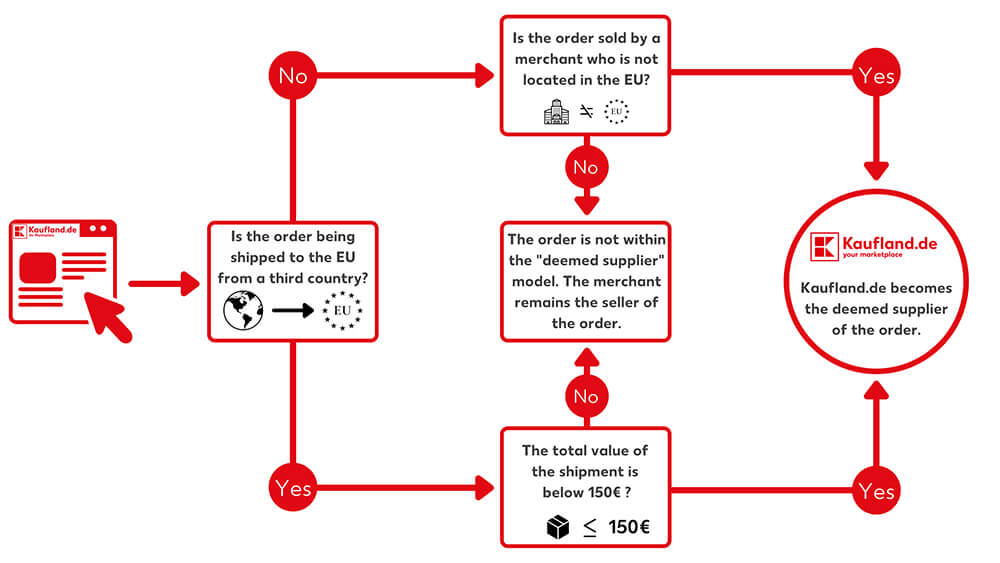

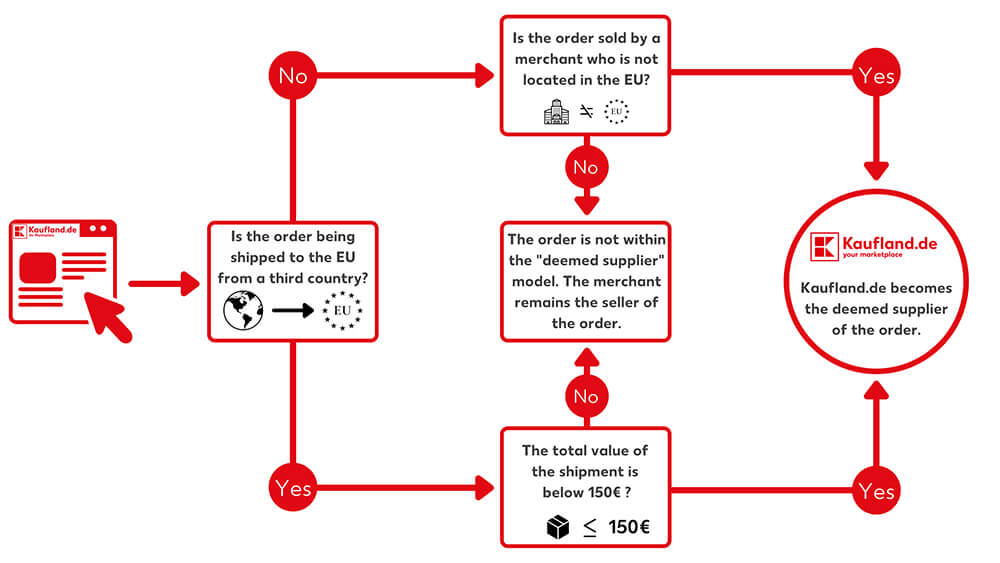

From July 1, 2021, for certain situations, the marketplace operator will be treated under a legal fiction as if the online marketplace itself had purchased the goods from the online seller and delivered them to the end customer ("Deemed Supplier" model). As a result, the marketplace becomes the "Deemed Supplier" and is obliged to determine and pay the VAT on B2C sales of goods on Kaufland.de. The change applies ONLY to sellers where the following transactions occur for B2C sales on Kaufland.de:

The "deemed supplier" model is identified based on the sellers headquarters, warehouse location, and value of goods in the shipment.

Source: https://ec.europa.eu/taxation_customs/business/vat/online-electronic-interfaces_en

-

For which sellers does the "Deemed Supplier" model apply?

The change applies ONLY to sellers where the following transactions occur for B2C sales on Kaufland.de:

-

What will change for sellers if a "Deemed Supplier" model exists after July 1?

Kaufland.de will be treated under a legal fiction as if the online marketplace itself had purchased the goods from the online seller and delivered them to the end customer.

This new procedure involves some changes with regards to billing documents (vis-à-vis you and the end customer) and the commissioning or shipping of the goods:

Please note that these changes have no impact on transactions outside the "Deemed Supplier" model. Here, there will be no changes with regards to the currently applicable requirements for the deduction of VAT.

Source: https://ec.europa.eu/taxation_customs/business/vat/online-electronic-interfaces_en

-

How do I know which sale should be treated under the "Deemed Supplier" model?

In the future, we will provide the information whether an order is placed within or outside the "deemed supplier" model scheme with every order you receive. This information is displayed in the Seller Portal and via the API. This way, you will always know how to act with regards to billing documents and commissioning or shipping of the goods as soon as you receive the order.

Seller Portal: For each individual order we will indicate in our Kaufland.de Seller Portal, whether the order is within or outside the "Deemed Supplier" model by means of an additional flag and an additional info field.

API: For each individual order we will also indicate the information "is_marketplace_deemed_supplier" true/false as an additional attribute in the API responses for the following endpoints starting 5/13/2021:

GET /orders/seller/

GET /orders/{id_order}/

GET /order-units/seller/

GET /order-units/{id_order_unit}/Initially, the value for "is_marketplace_deemed_supplier" will be set to "false" by default. From July 1, 2021 the correct values "true/false" will then be transmitted.

Please note that it may happen that you receive orders with products that are only partially affected by the regulations of the "Deemed Supplier" model.

Example: Your company is located in a non-EU country and a customer from the EU orders item A and item B with a value of 160 euros each. You ship item A from a warehouse in a non-EU country and item B is shipped from a warehouse within the EU. Since the value of item A is over 150 euros and the shipment is from outside the EU, the transaction does not fall under the "Deemed Supplier" model. Item B, on the other hand, is a transaction under the "Deemed Supplier" model because it is shipped from an EU country to an end customer in the EU and your company is located outside the EU.

To simplify this rare but possible case and related processes for you, you will receive two orders at the same time for such cases in the future. This will help you and us to process the cases correctly.

-

Do I have to provide a German VAT ID number and a German tax number to continue selling at Kaufland.de after July 1?

If your company is located in an EU country, you will have the following options in your Seller Portal on Kaufland.de, prospectively from CW 25:

If you have already submitted a German VAT ID and a German tax number and you continue to use them, nothing will change for you.

If you do not have a German VAT ID and a German tax number and you use the OSS, prepare to provide the information in your Kaufland.de Seller Portal in CW 25.

If neither of the two options are entered by July 1, 2021, we will unfortunately have to hide your offer on Kaufland.de.

If your company is not located in the EU, you need to provide a valid German VAT ID and a German tax number. Otherwise we will unfortunately have to hide your offer on Kaufland.de. If you do not yet have a German VAT ID, you can apply for one at the German tax office responsible for the country in which your company is based.

-

When will Kaufland.de stop requesting tax certificates according to §22f UstG?

After July 1, Kaufland.de will no longer accept German tax certificates according to §22f UstG and will continue to require a valid German VAT ID and German tax number. If you do not have a valid German VAT ID and a German tax number on file by July 1, 2021, we will unfortunately have to hide your offer on Kaufland.de. If you already have a German VAT ID and German tax number on file, there is no need for you to take any action.

-

Why am I being asked to provide additional information in the Seller Portal?

As a marketplace, Kaufland.de requires additional information from you as a basis for paying the VAT and for creating the accounting documents in the "Deemed Supplier" Model. To keep the effort on your side as low as possible, we have linked the requirements in the Seller Portal to your company headquarters:

HQ registered outside the EU:

HQ registered within the EU:

More details on this topic can be found under the next questions.

From CW 22 you can enter the details in your Kaufland.de seller account. Make sure that you have entered the data completely and correctly by 16 June 2021. If no updates are made by 1 July 2021, we reserve the right to hide your offers on Kaufland.de.

-

What is a permanent establishment?

In general, a permanent establishment exists, if there is a fixed facility from which the business activity is carried out. In particular, this includes the place of management, branches, offices, manufacturing facilities and workshops. The permanent establishment is registered for tax purposes and has in addition to the VAT ID no. another tax number for income tax purposes.

If you are unsure whether you have a permanent establishment in an EU-Member State, please contact your tax advisor. -

What changes for me if I have a permanent establishment in the EU as a third country seller?

If you have a permanent establishment in the EU, you will be treated as a seller established in the EU with regard to the new EU VAT regulation. The "Deemed Supplier" model does not apply in this case for the movement of goods in the EU. If the goods are delivered from a non-EU country, this delivery also falls under the new “Deemed Supplier” model.

-

Where do I get a permanent establishment certificate?

You can apply for the certificate at the responsible tax authority in the country of the permanent establishment and it must not be older than 6 months. The certificate is issued in accordance with local legislation and should include i.a. the following information:

-

What information do I need to provide about my existing warehouses?

Due to the new EU VAT regulation effective from July 1, 2021, an assessment of your warehouse settings is required. You will be notified in the Seller Portal to update this information from CW 21, 2021.

HQ registered within the EU:

HQ registered outside the EU:

Please note that in case of the "Deemed Supplier" model, the assigned warehouse and warehouse country is the basis for the creation of the billing documents.

If you use the service of a pre-supplier or a fulfillment service provider where you do not know all the locations of the goods you offer, simplified information about the warehouse location is sufficient. In principle, however, you can ask your fulfillment or dropshipping service provider for these.

Please pay attention to always keeping your warehouse details on Kaufland.de up to date. In case of dispatch of goods from a warehouse located in a non-EU country, please make sure to assign your offers to one of your warehouses in a truthful manner.

-

I am asked to assign a warehouse to my offers and I use a software partner for the offer transfer. Will automatic assignment be possible?

We have already contacted our software partners on May 6, 2021 and informed them about the changes. If your software partner does not support the transfer, please contact your software partner contact person again separately.

-

What is the One-Stop-Shop (OSS)?

The OSS is an electronic portal which simplifies for online sellers and electronic interfaces and aims at simplifying VAT obligations on e-commerce sales within the EU to consumers. Each EU Member State has an online OSS portal where businesses can register.

Source: https://ec.europa.eu/taxation_customs/business/vat/oss_en

-

I am a EU seller and do not have a German VAT ID and German tax number. What do I have to do?

the German VAT Act in 22f (1) No. 3 requires the application of a German VAT ID for all sellers who sell goods to German end customers. An exception applies to sellers based in the EU who use the OSS procedure. If your company is located in an EU country, you have the possibility to choose between one of following options:

-

I am an EU seller and already have a German VAT ID and German tax number. Do I also need to register to OSS?

If you already have a German VAT ID and a German tax number and you maintain these, you do not need to enter OSS-information in the Kaufland.de Seller Portal, even if you declare taxable sales in Germany via your OSS registration. However, if you delete your registration in Germany and your German VAT ID and German tax number are no longer valid, then it is mandatory that you provide us with the VAT ID of the Member State in which you registered in the OSS.

-

What are Dropshipping- or Fulfillment Warehouses?

Dropshipping means that you sell products, which you do not have in stock. Instead, you pass on the sales order to the third-party supplier, who takes over the whole shipping process and ships the order to the customer.

Fulfillment means that a provider handles the shipping process in full or partially and ships your product from their warehouse to the customer.

If you use a dropshipping or fulfillment service provider, you must also enter this warehouse information, which you can request from your fulfillment or dropshipping service provider, in your Kaufland.de Seller Portal. We have adapted our system for you so that reduced information is possible for these cases.

Please note that providing this information is necessary to identify the "Deemed Supplier" model and to create appropriate accounting documents for you.

-

How can I assign an article to several warehouses?

A seller is only allowed to make one offer per EAN per article state of the product. An exception to this is when a seller sends one article from several warehouses. If this is the case for you, you can create one offer per warehouse per article and you can then assign the offer to the respective warehouse. Also remember to adjust the corresponding shipping costs and delivery times.

-

Why am I no longer allowed to send an invoice to the customer in the case of the "Deemed Supplier" model?

In the case of orders within the "fictitious supplier" model, Kaufland.de will be treated as a "fictitious supplier" from July 1, 2020. This means as if it had purchased the goods itself from the online seller and delivered them to the end customer. The marketplace is thus obliged to calculate and pay the sales tax on B2C goods sales on Kaufland.de.

For this reason, online sellers cannot issue an invoice including VAT, as they do not receive and pay it and are therefore exempt from the obligation to issue invoices. Kaufland.de will therefore take over the invoicing to the customer in the future. For this reason, sellers are no longer allowed to issue invoices to end customers.

-

What exactly are credit notes, which will be issued for orders in the "Deemed Supplier" model in the future?

Credit notes represent the official settlement document for orders around the "Deemed Supplier" model and are an invoice from the online seller to Kaufland.de for tax purposes, except that this invoice is issued by Kaufland.de. Since Kaufland will be treated as a "deemed supplier" for such orders as of July 1, 2021, as if it had purchased the goods itself from the online seller and delivered them to the end customer, a credit note will be issued instead of a (commission) invoice. For orders outside the "Deemed Supplier" model, you will of course continue to receive (commission) invoices.

-

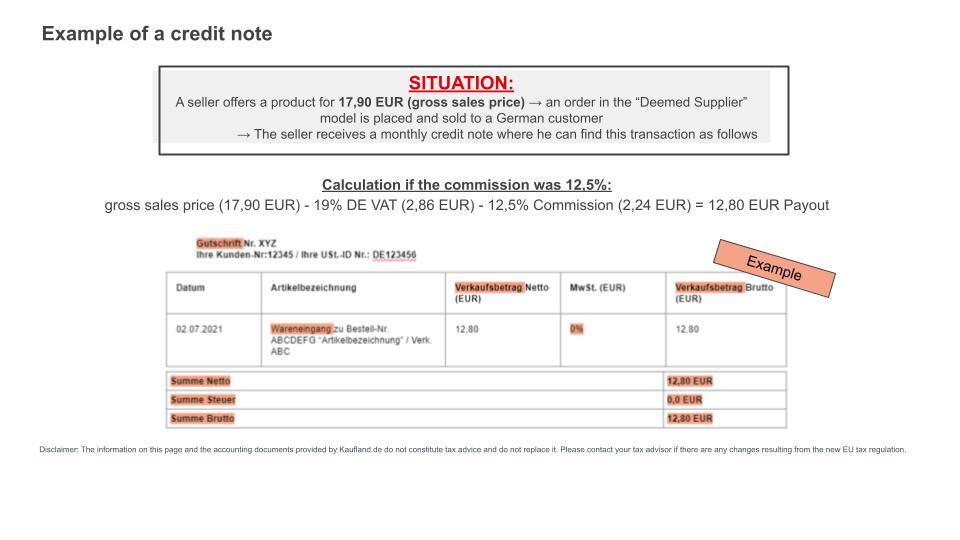

What information will be found on credit notes, for orders in the " Deemed Supplier" model?

Credit notes are issued in the same way as (commission) invoices - monthly, in cumulative form. This means that you will see one line per order with the individual positions and at the end of the document the total of all orders placed in the month. For orders outside the "Deemed Supplier" model, you will still receive (commission) invoices. In case you have warehouses from which you ship products sold on Kaufland.de in multiple countries, you will always receive a monthly credit note per EU-warehouse.

Displayed on the credit note, in each line and accumulated at the end, is your final payout amount as the sales price from you to Kaufland.de as the "deemed supplier". For each individual line item and the total at the end, 0% VAT is always shown, as Kaufland.de has already collected and paid the VAT to the respective tax authorities. Your payout amount is composed of the gross sales price to end customers, minus the VAT (e.g. 19% for sales to German end customers) and minus the applicable commission.

-

What will credit notes, for orders in the "Deemed Supplier" model, look like?

-

What changes for me as a seller in the import process for orders in the "Deemed Supplier" model?

There will also be changes for you if you are shipping orders within the "Deemed Supplier" model from outside the EU. Essentially, you need to consider the following three points:

-

Where can I find the Kaufland.de IOSS number for the import process of orders in the "Deemed Supplier" model?

You can find the Kaufland.de IOSS ID number in your seller account by clicking on Shop settings and then on the icon IOSS-ID. You will receive this number here and can access it again if necessary. This number does not change, so there is also only one number that you have to provide for your orders. Please note that you are only allowed to use this number for importing your Kaufland.de orders and that you always need to keep this number confidential and not share it with third parties.

Disclaimer: The information on this page and the accounting documents provided by Kaufland.de do not constitute tax advice and do not replace it. Please contact your tax advisor if there are any changes resulting from the new EU tax regulation.